Business Insurance in and around Petal

One of Petal’s top choices for small business insurance.

No funny business here

This Coverage Is Worth It.

Running a small business requires much from you. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, specialized professions, trades and more!

One of Petal’s top choices for small business insurance.

No funny business here

Protect Your Future With State Farm

You are dedicated to your small business like State Farm is dedicated to fantastic insurance. That's why it only makes sense to check out their coverage offerings for builders risk insurance, business owners policies or worker’s compensation.

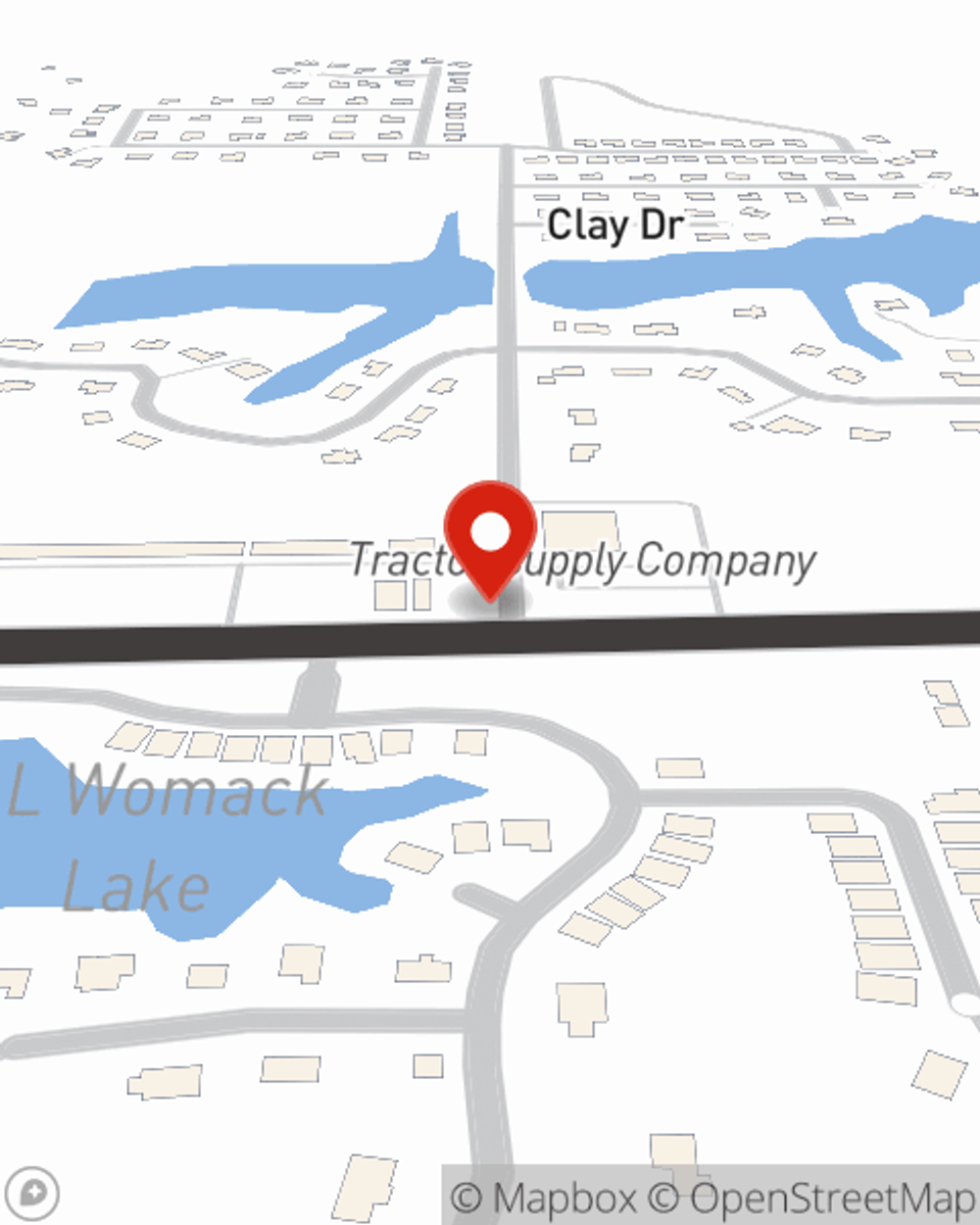

The right coverages can help keep your business safe. Consider stopping by State Farm agent Adam Patrick Jr's office today to discover your options and get started!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Adam Patrick Jr

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.